Note to the reader: This is the eighteenth in a series of articles I’m publishing here taken from my book, “Investing with the Trend.” Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of facts. The world of finance is full of such tendencies, and here, you’ll see some examples. Please keep in mind that not all of these examples are totally misleading — they are sometimes valid — but have too many holes in them to be worthwhile as investment concepts. And not all are directly related to investing and finance. Enjoy! – Greg

Weight of the Evidence Measures

I have been fond of a weight of the evidence approach for more than 30 years.

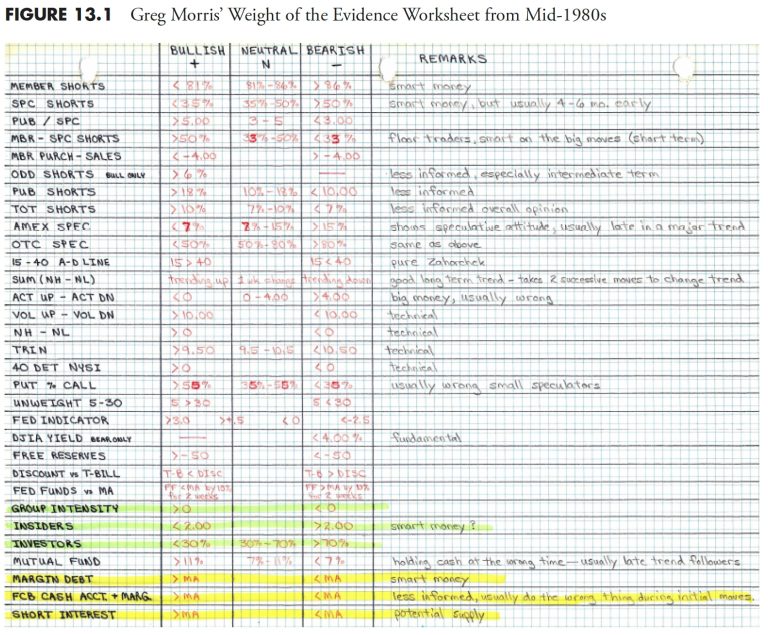

The concept of “weight of the evidence” came from Stan Weinstein, who published the newsletter The Professional Tape Reader and is the author of Secrets for Profiting in Bull and Bear Markets. Back in the early 1980s, most analysis was done manually. We did not have computers, Internet, or e-mail. Our data came from subscriptions or newspapers. I was a religious user of the Barron’s Market Laboratory pages. I was working with Norm North of N-Squared Computing then, designing technical analysis software (yes, it was DOS-based and ran on 5.25″ floppies). Norm had started a database of about 130 items from the market lab pages and, each Saturday, I would go to the nearby hotel, buy a copy of Barron’s, update the database then upload it to CompuServe so our clients could download it—all at the lightning fast speed of 300 baud. I ‘m somewhat of a packrat, and have many ring binders full of charts and notes; Figure 13.1 is the weight of the evidence approach I used back then. Wish I could print like that now.

I have totally stopped using the sentiment measures because I think the data collection process is not reliable. If you have ever taken a survey, especially an unsolicited survey, you can probably guess where I ‘m coming from. However, that does not mean the data isn’t worthwhile—just not for me. There is, however, an excellent service provided by Jason Goepfert called SentimenTrader at www.sentimentrader.com. Jason provided an example of a sentiment indicator that can be used in trend analysis.

Figure 13.2 is the put/call ratio, which tends to trend along with the market. We see a higher average range during bear markets and a lower average range during bull markets. That has changed a little bit over the past decade, as there has been a structural shift to higher put/call ratios—more hedging from nervous investors who have been whacked with two big bear markets. But you can still see the trend in the ratio from a bull market to the next bear market.

I also no longer use any of the NYSE member/specialist data or odd-lot data, as most doesn’t seem as valid today as then. Now, the technical trend-following measures that make up the weight of the evidence consist of price, breadth, and relative strength indicators.

A Note on Optimization

When evaluating indicators to be considered for trend following, you cannot optimize over long-term periods and then just pick the best performing indicator. That is a guarantee of failure, probably quite soon. Optimization is a great process in which to discover areas to avoid, but a poor process to actually determine parameters. If you do try to optimize then please read some good book on the downfalls of doing so. Optimization in the wrong hands is extremely dangerous.

One area of value is to plot all of parameter’s performance and look for plateaus (box) where the parameter performed steadily over a range of similar values. Picking a spike (circle) is the worst thing you can do, as the parameter surrounding the spike are probably closer to where you will see the actual results. See Figure 13.3.

Indicator Evaluation Periods

Indicators need to be evaluated over cyclical bull and bear markets, secular markets, periods covering calendar-based times, randomly selected periods, and almost any other period selection process you want to try. Remember, the goal is to find parameters that meet the needs of the model you are trying to create. You want indicators whose statistics over various times provide the safety and return that you expect of them. Ideally, you want to test the indicators with a certain portion of your data, get the parameters that work well, and then check it on the remaining portion of your data. This is known as in sample and out of sample testing. If the indicator continues to perform on the previously unused data, then you probably have something.

Figure 13.4 shows the Nasdaq Composite Average and the S&P 500 Index. The vertical lines are placed at each low and high that can be used to determine the evaluation periods. You must be careful with this and include the significant peaks and troughs when viewed over the long term. In fact, using a weekly price chart is probably better for this than using a daily price chart.

The remainder of this section covers many of the weight of the evidence indicators (measures) that are good for trend following. These can be separated into three broad categories: price, breadth, and relative strength.

Price-Based Indicators

Price-based means that the indicator is measuring movement in price instruments, whether it be from an index such as the Nasdaq Composite Average, the S&P 500, or from an individual security, such as an ETF, a stock, a mutual fund, and so on. I use the Nasdaq Composite for my price guide because it is a high beta index that contains small caps, mid-caps, large caps, technology, just about everything except financials, and also has some dogs. If you are going to be a trend follower, then you want to follow a price-based index that moves; it doesn’t matter if it is up or down, it just needs to do so in a big way, and the Nasdaq Composite fills the bill.

Price Short Term

The short version of price is more for shorter-term assessment of trendiness. It is simply looking at the price relationship in the 5- to 21-day range. If you were using multiple price measures on the same index, then this is the one that would turn on first and also turn off first; it is the quickest to respond to changes in price direction. Many times, a short-term measure is not actually used in the weight of the evidence calculation, but serves a weight of the evidence model well with an advance warning of things to come.

Price Medium Term

This is another price trend measure that uses a different analytical technique and different look-back period than the Trend Capturing component. This Price Medium measure is basically looking at the price relationships over a three- to four-week period. If the short-term price measure isn’t used, then this is the one that will lead the changed in direction of the index being followed.

Price Long Term

This price trend measure is similar to Price Medium, but looking at the price relationship over a four- to eight-week period. Generally, the Price Medium indicator will turn on first, and, if the trend is sustained, the Price Long measure will turn on, thus providing confirmation of the trend and further building the point total of the cumulative weight of the evidence.

Figure 13.5 is an example of the Price Long measure. Although this is almost too much data on one chart, you can focus on the binary overlay on the top plot and can see that it does a good job of tagging the uptrends, which is all we want it to do.

Figure 13.6 shows the same price measure as the one above, just a smaller timeframe. It becomes much clearer that the binary line overlaid on the top price data moves in conjunction with the indicator in the bottom plot, the price long measure. Whenever the price long indicator moves above the horizontal line, the binary moves to the top, and whenever the price long drops below the horizontal line, the binary drops back to the bottom. You can then see that whenever the binary is at the top, it is signaling an uptrend, and whenever it is at the bottom it is signaling no uptrend (down trend or sideways). This concept is quite valuable since it allows you to view only the binary to know what the indicator is doing.

So is this indicator perfect? Of course not, you can see there was a whipsaw signal (short and wrong, but also quickly reversed) near the right center of the chart where the binary was at the top for only a very short period of time. As I have said before and will no doubt say again, I know these measures will be wrong at times, but they are not going to stay wrong because they react to the market. Because these indicators are all trend following, they will reverse a wrong direction almost as fast as they identify it in the first place. That is exactly what you want them to do and it is also why I use a weight of the evidence approach, which means I rely on a basket of technical measures. Sort of a democratic approach, if you will.

Table 13.1 is an example of the detailed research behind each of the various indicators used in the weight of the evidence. This example is over the period from 1980 to 2012; however, it should be run over many different periods (see Figure 13.4) to find consistency.

Here is an explanation of the various parameters in Table 13.1:

Parameter. These are the variable parameters used to test the indicator’s usefulness in identifying trends. They can be discovered by optimization, or just a visual analysis of the indicator. They are then spread about to cover a wide range of analysis for the indicator.Winning years. The percentage of years that the trading ended higher than the close from the previous year.Trades per year. This is the number of closed trades per year.Average return per year. Determined by looking at the total return for the entire run, and then dividing it by the number of years.Total return. The total return from the system using the selected parameter.Compounded annual return. The gain each year that would be required in order to achieve the total gain for the analysis period.Compounded annual return while invested. The annual gain that would be required to achieve the total gain, excluding cash positions, over the period being analyzed.Percentage of time invested. The percentage of time that actual trades were placed and not in cash.Ulcer index. A measure of downside volatility also covered in the ranking measure section of this book.Largest trade loss. A single trade that resulted in the largest loss.Maximum drawdown. The maximum decline of the system measured from the highest level that the system had reached. Keep in mind this is a one-time isolated event.Ulcer performance index. The compounded annual return divided by the Ulcer index, this is a performance measure similar to the Sharp ratio, the Sortino ratio, and the Treynor ratio. All are risk-adjusted measures of performance.

Although the calculation of all the various measures of an indicator’s ability to work over a vast number of trials and time segments, one still has to determine “Where’s the beef?” Of all that data generated, shouldn’t you list the categories from best to worst inasmuch as their contribution to what you looking for? I think so, definitely so. One method, and the one I use, is to ask some sharp folks who are deeply familiar with the indicator and the output to give me their input as to the order in which the parameter analysis should be viewed. And to keep this as a robust process, it is done each year. Often, there isn’t much change, but sometimes someone gets a more involved feeling after working with these almost every day as to which is more important than another. Sometimes the overall relative ranking of these gets changed.

Table 13.2 shows that each column of data is ranked based on its relative importance as determined by the individuals involved in the portfolio management process. This relative input is then weighted based on the level it has reached in the vetting process. There is an old forecasting axiom that says the average of all estimates is probably going to work better than trying to select the single best guess.

Note: The columns with Inverted at the top mean that the smaller the value, the better it is performing.

The relative ranking is then placed alongside the parameter output to see where the current parameter being used is, and followed immediately by the ranking of the output components shown in the first column of Table 13.2. This process allows you to see how the parameters change over time compared to the one currently in use. Note that the parameters in the first column of Table 13.1 are in numerical order, so, while this is a change in the relative ranking, if the change in the parameter is small, then generally no changes will be made to the parameter in this weight of the evidence indicator. However, it will be watched over time and, if there is an obvious drift away from the parameter being used, a change will be considered.

The above performance statistical information provided for the price long weight of the evidence will not be included in all of the indicators that are used, as this section would get overly long. However, when something stands out that will provide additional insight into this process; the information will definitely be shown. However, do not fear; a chart or two will be shown for each measure.

Risk Price Trend

The risk price trend is in the lower plot of Figure 13.7, while the top plot is the Nasdaq Composite and the risk price trend binary. This measure uses the MACD concept with considerably longer parameters for both the short- and long components. You can see from the binary that it does a relatively good job of picking out the trends of the market.

Adaptive Trend

The adaptive trend measure incorporates the most recent 21 days of market data to compute volatility based on an average true range methodology. This process always considers the previous day’s close price in the current day’s high low range to ensure we are using days that gap either up or down to their fullest benefit. When the price is trading above the adaptive trend, a positive signal is generated, and when below, a negative signal is in place. This is clearly shown in Figure 13.8, with the adaptive trend binary overlaid on the price chart at top. Whenever the binary is at the top, it is showing an uptrend, and when at the bottom, a downtrend.

Breadth-Based Indicators

Breadth contributes significantly to trend analysis and is thoroughly described in this chapter and the Appendix. Breadth-based indicators offer an unweighted view of market action, a valuable view that is often obscured by price or capitalization weighted indices.

Advances/Declines

The advance/decline component measures the relationship of advancing issues to declining issues. Advancing issues outnumbering declining issues is a positive event, as more participation is taking place in the equity markets. However, an inverse relationship (decliners outnumber advancers) would be a clear sign of weakness to a price movement.

There was an example of the clear divergence in the price movement and market internal movement during much of 2007, and particularly in the fourth quarter of 2007. From early October 2007 to late October 2007, we saw a distinct positive price trend while the advance decline measure was rapidly declining. By late October, the markets were reaching all time new highs. What you were reading and hearing in the news was all positive, “The market reached an all-time new high.” According to the price movement, things couldn’t have looked better. However, the advance/decline measure was telling us a very different story, as declining issues continued to outnumber advancing issues. This forewarning was signaling increased risk, as the upward price movement was not being supported by broad participation. At that time, the advance/decline component was negative; hence, it was not contributing to the weight of the evidence total. Divergences can cue us to be prepared in the event the price action reverses rapidly. In fact, that is exactly what happened, and it was the beginning of the 2007 to 2009 bear market.

Figure 13.9 shows the deterioration in the advance decline measure in 2007. You can see that while the market was reaching new highs, the advance decline measure never even got back up to its horizontal signal line. Breadth does this time and time again. It almost always leaves the party early and is a great tool to have in your arsenal as a trend follower.

Figure 13.10 is the same indicator, but plotted with the same data used throughout this section, so cross reference is easier.

Up Volume/Down Volume

This Breadth measure gives us an internal look at the volume behind the price action by looking at the relationship of the volume in advancing issues versus the volume in declining issues. Again, by removing the capitalization weighting of the price movement that can drive the index price, this measure gives us an internal view of what is going on behind a price movement. Generally, if there is strong up volume relative to down volume, it is a positive sign that the positive price movement is being supported. However, if there is positive price movement, but down volume is greater than up volume, it is a sign that the price movement lacks participating volume. In this case, the up volume/down volume measure would not contribute to the weight of the evidence, leading to a lower total level signaling increased risk.

Figure 13.11 is the up volume/down volume weight of the evidence measure. You might notice that the signal line (horizontal line) is not at zero like many use, but, in this case, it is at +400. The parameter analysis identified that this was a significantly better signal level. You can see that the up and down volume has been quite weak since and before the peak in prices, which occurred in the middle of the time period shown.

New Highs/New Lows

The High/Low Breadth measure looks at the relationship between issues reaching new 52-week new high values to issues hitting new 52-week new low values. Generally, when the number of issues reaching new 52-week highs are outpacing the number reaching new 52-week lows, there is a positive indication in support of positive price action. The flip side of more new lows to new highs is a negative indication, and this lets us know that there is potential risk that the price action and prices could possibly turn quickly in the other direction. When this indicator is on, we have internal support for positive price movement, and it adds to the point value of the weight of the evidence.

This weight of the evidence measure is a little different than the previous ones, in that signals are generated by the crossing of the indicator’s moving average shown in Figure 13.12 the bottom plot as the dotted line. You can see the binary in the top plot makes seeing these crossings quite easy.

Breadth Combination Measure

The combination breadth measure (Figure 13.13) uses advancing and declining issues, as well as advancing volume and declining volume, by weighting the significant volume days inside of the indicator. This component serves to underweight insignificant price movements if the volume is weak, while weighting the more significant price movements when volume is significant. This measure was created out of concern for days such as the Friday that follows Thanksgiving, a partial day of trading, and always with very low volume. The downside of using breadth is that it does not matter if the day is shortened or the trading is light; you will always end up with a full complement of breadth data. Remember, breadth does not measure magnitude directly, only direction. In this measure, when the up volume is below a predetermined moving average, then only the advances are used. If the up volume is above this average, then the product of advances and up volume is used. The same concept is applied to the declines and the down volume.

Breadth Is Not Always Internal Data

There are a number of breadth-based measures that do not use internal market data such as advances, declines, up volume, down volume, new highs, or new lows. A concept known as the Percent Participation Index is used by many analysts. The concept is simple, yet revealing: it measures the number of stocks in an index as to where they are relative to their moving average. For example, many use a 200-day Participation Index, which shows the percent of stocks that make up the index that are above their own 200-day moving average.

Figure 13.14 shows the Nasdaq Composite in the top plot with its 200-day simple moving average. The bottom plot is the 200-day participation index, which shows the percentage of all Nasdaq Composite stocks that are above their respective 200-day simple moving averages.

Figure 13.15 is similar to the previous one, except that it shows the 50-day participation index.

Slope of Moving Average

A longer-term big picture measure of market movements can be accomplished by calculating the slope of a moving average, in this case the 252-day moving average. This is the type of market measure that can be used as a filter for parameter changes. For example, whenever the histogram in the lower plot of Figure 13.16 is above the zero line, the stops can be looser, the buying requirements can be looser, and even other market measure parameters could be lengthened. If it is below the horizontal line, then revert back to the tighter set of parameters.

World Market Climate

This is a breadth measure that uses a basket of international indices and their respective moving average relationship. For this example, this measure uses a basket of international stock market indices and their 50-day exponential average. The measure is bounded between zero and 100 because all that is being done is determining the percentage of the basket of indices that are above their 50-day exponential average. Complementarily, this will also tell you the percent below their 50-day moving average. Figure 13.17 has the World Market Climate shown in the top plot with lines drawn at 80%, 50%, and 30%. The bottom plot is the MSCI EAFE Index, which is a broad-based international index using markets from Europe, Australasia, and the Far East. Australasia is Australia, New Guinea, New Zealand, and their neighboring islands. Clearly the goal of EAFE is to include a broad international exposure outside North America. The EAFE in the bottom plot is shown with a 200-day exponential moving average, just for reference.

Cyclical Market Measure

This measure looks for longer-term price trends to identify cyclical bull or bear environments. For this example, I use the basket of international markets discussed in the previous measure. The concept is unique, yet simple; it measures the direction of longer-term averages and uses a filter of 0.05% before a reversal of the average is identified. Figure 13.18 shows the Cyclical Market Measure in the top plot, with a horizontal line at 50% and the MSCI EAFE Index in the bottom plot with a 126-day simple moving average. One could use any values for the length of the moving average, both for the smoothing of the EAFE in the lower plot to the calculation of trending percentage that makes up the Cyclical Market Measure.

Thanks for reading this far. I intend to publish one article in this series every week. Can’t wait? The book is for sale here.