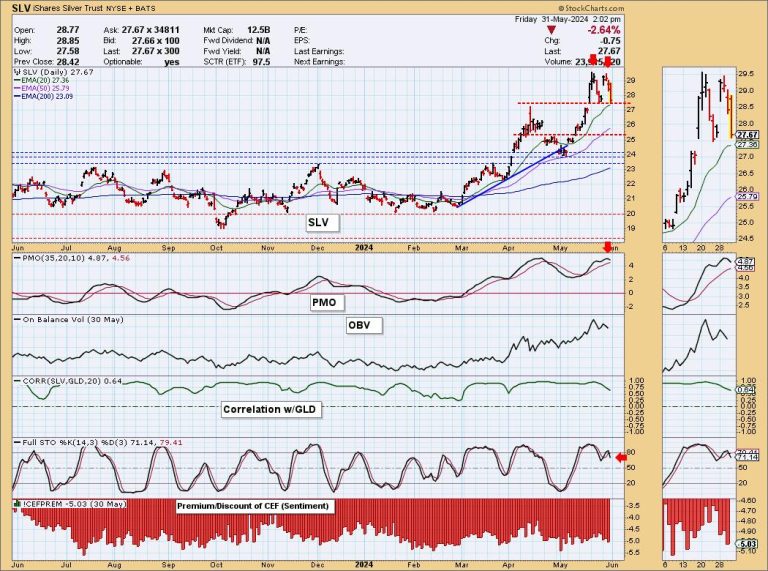

Gold is struggling, moving mostly sideways. Silver has technically been moving sideways as well only it has formed a textbook double top chart pattern. Textbook double tops show even tops and a clear confirmation line delineated at the middle of the “M” formation. What is good about these formations is that they give us a minimum downside target.

The downside target is determined by the length of the pattern subtracted from the confirmation line. In the case of Silver that would bring it down to prior gap support. But remember, this is a “minimum” downside target. It could fall further.

The Price Momentum Oscillator (PMO) has topped for a second time in overbought territory. Stochastics are falling. The technicals are failing on Silver so we should be prepared for this decline to catch fire.

Conclusion: We have a bearish double top on Silver (SLV) that predicts a minimum downside target around 25.00. Prepare for more downside on SLV.

Learn more about DecisionPoint.com:

Watch the latest episode of the DecisionPointTrading Room on DP’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

Trend Models

Price Momentum Oscillator (PMO)

On Balance Volume

Swenlin Trading Oscillators (STO-B and STO-V)

ITBM and ITVM

SCTR Ranking

Bear Market Rules