What will the stock market look like in 2023? It’s hard to tell, but these five charts could elevate your market awareness by a few notches.

Forecasting stock price movement is never easy, not even for the most experienced stock investor. As an investor or trader, the closest you can come is to keep an eye on a handful of charts that help give a big-picture view of the stock markets and to be aware of market internals. But which charts should you be watching?

David Keller, CMT, our chief market strategist, discussed his top 5 charts for 2022 in his StockCharts TV show The Final Bar. And the charts he used could be on your top 5 list going into 2023. Which charts make it to Keller’s top 5 list? Let’s find out.

The TL;DR

S&P 500 Index with Fibonacci retracement levels10-Year U.S. Treasury Yield IndexU.S. Dollar Index vs. gold and crude oilA mega-cap stockThe Chart, which is a combination of a broader index and sentiment indicators to help identify potential turning points in the stock market.

A Deep Dive Into the Top Charts

One of the challenges in keeping an eye on the stock markets is that there are many moving parts. These five charts make you aware of what’s going on in the most important areas of the financial markets and alert you to when investor sentiment may be changing.

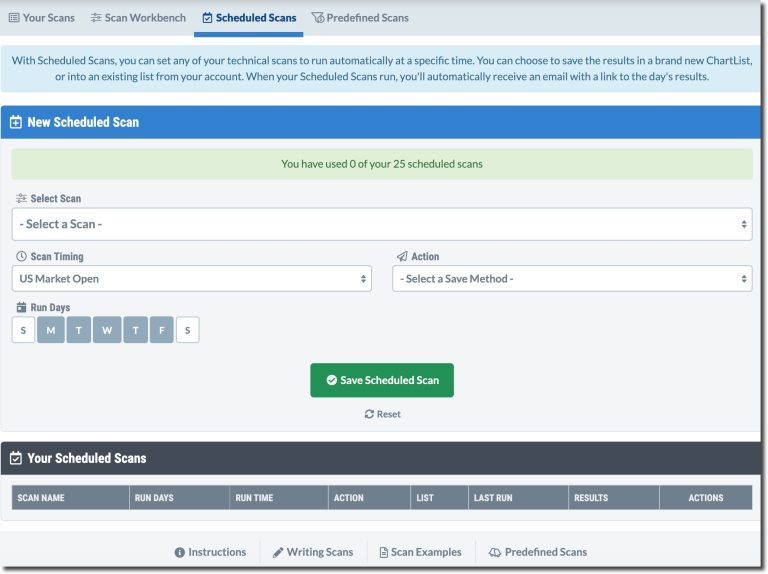

Bonus Gift: Access the top 5 charts here. Save them to your ChartLists and follow along.

#1: S&P 500 Index With Fibonacci Retracement Levels

It goes without saying that one of the most talked-about charts when it comes to the stock market is the S&P 500 Index ($SPX). Money managers use it as a benchmark, but, besides that, it’s a good one to get an overarching view of the market. And when you add Fibonacci retracement levels (Fib levels) to the $SPX chart, you can identify areas of support and resistance levels and areas where investor behavior is changing.

Pull up the chart from the link above and, starting from the March 2020 low, see how $SPX reacted to the different Fib levels. You may notice that there’s a second set of Fib retracement levels from the September 2020 low to the January 2021 high. Both sets help to identify potential turning points in $SPX.

How To Add Fibonacci Retracement Levels

Bring up a chart of any stock, index, or exchange-traded fund (ETF).Select Annotate.Select Fibonacci arcs icon > Fibonacci RetracementSelect a high or low point, hold down your cursor, and drag to the low or high point to the right of your original point.Once you’re satisfied with your high and low point, release cursor, select the X on top right of chart, and save the chart.

In 2023, the 3800 level will be a key level to watch. If $SPX goes lower, the next level would be 3500 and, below that, 3200. “The bottom isn’t necessarily in for the current market cycle,” Dave noted. “January is typically the weakest month of the year, and Q1 and Q2 earnings may impact the overall markets. So, perhaps the 3200 level in $SPX is possible.”

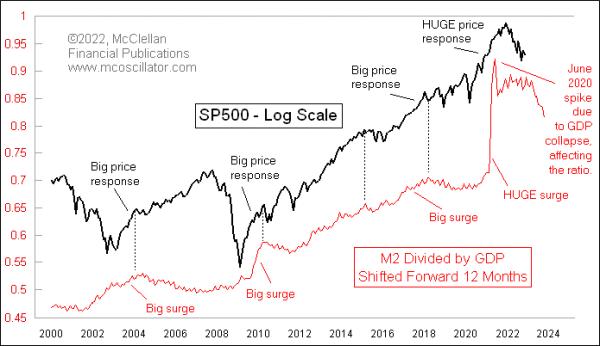

#2: 10-Year U.S. Treasury Yield Index

Inflation is front and center in every investor’s mind, and more interest rate hikes are likely in 2023. Interest rate decisions impact the equity markets, especially when it comes to growth and value stocks. “When interest rates go higher, value stocks tend to do better and, when interest rates go lower, growth stocks tend to do better,” added Keller. For this reason, it makes sense to compare the 10-Year U.S. Treasury Yield Index ($TNX) to the performance of value to growth stocks and to look at the overall shape of the yield curve.

How to Access the Dynamic Yield Curve

From Your Dashboard, scroll down to Charting Tools in Member Tools.Select Dynamic Yield Curve.View a snapshot or animate the chart to see the changes in the yield curve.

The Dynamic Yield Curve helps to see if the curve is steep, flat, or inverted.

Interest rates are likely to go higher in 2023, which means bond and equity prices are likely to come down. But it’s possible that other themes could play out similar to what we saw in 2022—when $SPX was trending lower, the Energy sector did well in the early part of the year, and Industrials and Materials did well later in the year.

This second chart can help you see if value stocks are outperforming growth stocks. So, depending on the leadership theme, you could invest accordingly.

#3: U.S. Dollar Index vs. Gold, Crude Oil

Intermarket analysis shows how different assets—stocks, bonds, commodities, and currencies—are related. Understanding these relationships can provide additional market insight. For example, when stocks are trending lower, investors are likely to invest in risk-off assets such as gold.

The price of crude oil can impact consumer behavior—higher oil prices could reduce driving and travel, which in turn can impact airline industry performance. A stronger dollar could benefit U.S. stocks, but may have a negative impact on the earnings of companies with global operations. Understanding relationships between the different assets can help you recognize when a change is taking place.

Looking at the third chart, you may want to keep an eye on the following:

Will the U.S. dollar revert back to its mean or continue moving higher?Will gold sustain its upward move or reverse?Will crude oil continue in its downward channel?

“Intermarket relationships help you analyze trends, determine probabilities, and position yourself for what you think is the optimal scenario,” Dave added. “More importantly, investors should plan for risk, since all large losses begin as small losses.”

#4: A Mega Cap Stock

It’s always a good idea to follow one of the mega-cap growth stocks. For 2022, Keller chose to analyze the stock of Alphabet (GOOG), for the following reasons:

During the post-COVID upward phase, the FAANG stocks were dominant during the upward phase. If you pull up any of those charts, you’ll see they have a similar movement. In the GOOG chart, you can clearly see the rotation from upside leadership to falling leadership. You can recognize three of the most important investing traits—identifying trends, following trends, and anticipating when trends are exhausted.

Adding price performance against SPDR S&P 500 ETF (SPY) helps to see how GOOG is performing with respect to the benchmark. On the chart, you can see various technical scenarios play out.

The 50-day moving average (MA) crossing below the 200-day MA.A divergence between the relative strength index (RSI) and price from September to December 2021.A break below the early 2022 support level.A lower RSI range during the bearish phase.

“This chart helps to see how the investment picture changed, how the signals rotated, and what levels were established or broken,” Dave noted. “It helps you understand how to apply risk management so you’re better prepared for the next boom and bust cycle.”

The mega-cap stock you choose for 2023 may be a different one, depending on what sector does well and which stock leads in that specific sector. There are different ways to determine the broad participation of sectors, which is why the next chart is important.

#5: The Chart

The fifth chart is a series of different charts that looks at market internals. The chart at the top can vary depending on prevailing market conditions. For 2022, $SPX made it to the top of the podium. Below the line chart of $SPX is the NYSE common stock advance/decline line, percent of stocks above their 50-day MA, S&P 500 bullish percent index, and the ratio of Consumer Discretionary to Consumer Staples. Scroll below the charts to see how to recreate this setup.

A couple of things to keep an eye on:

The clear downtrend line in $SPX.From December to January 2021, $SPX was making higher highs while the NYSE Common Stock A-D line made a lower high. This was an early indication that the uptrend may be exhausted.Look to see if the percent of stocks above their 50-day MA is above or below the 50% level. When $SPX is making higher highs but this indicator is below the 50% level, it should be a red flag.For the bullish percent index, look for extreme levels in market breadth—above 70 or below 30.The ratio of Consumer Discretionary to Consumer Staples is a measure of the overall stability of the market. It gives you an idea of whether investors are gravitating towards offensive or defensive strategies. You’ll see on the chart that this indicator didn’t provide a confirming signal during the January 2022 high in $SPX.

“This chart looks at three important points—price, breadth, and leadership—which help to measure risk-on vs. risk-off mentality. When all these indicators are in agreement, it’s an indication that change is afoot,” Dave concluded.

Looking to 2023

Now that you’ve got the top 5 charts, going into 2023, what should you be looking for? Here are a few pointers:

Watch the 3500 and 3200 Fib levels in $SPX. There could be buying opportunities at these levels.Will $TNX move lower towards its 200-day MA?Will gold continue moving higher?Keep an eye out for any rotation in large-cap stocks.Watch for a break in the downward trendline in $SPX and see if it’s confirmed by the A-D line, percent of stocks above their 50-day MA, and the bullish percent index. This will help determine if investors are moving towards risk-on investment strategies.

The bottom line: There’s no Holy Grail when it comes to forecasting stock price movements, but these five charts will help you stay alert to potential changes in the market. While some themes such as higher interest rates are likely to continue in 2023, the market is known for its ability to throw surprises. Be prepared to be unprepared.

Happy holidays from the StockCharts team.

Jayanthi Gopalakrishnan

Director, Site Content

StockCharts.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.